The Benefits of Employee Advocacy for Financial Services

Building brand trust is just as important as building your brand. Brand trust creates loyalty, boosts engagement, improves customer retention, and attracts new clients. For the financial services industry, brand trust is particularly important.

According to Gallup, more than half of Americans polled show worrying levels of distrust of financial institutions, similar to levels post the financial crash of 2008. Consumers are far less trusting than executives would like to think. According to PwC’s 2023 Trust Survey, the financial service sector has the largest trust mismatch on the question of customer faith in their business.

So, what’s the solution? Implementing an employee advocacy program.

Building brand loyalty is a major benefit of an employee advocacy program. When your employees create and share quality content, it’s viewed as more authentic, which over time builds trust. Your audience will trust your brand’s products or services as the solution to their problems.

For financial services brands that are looking to attract and retain clients, an employee advocacy program can help them achieve that brand trust.

In this article, we’ll explain how social media helps financial services, plus share content and employee advocacy strategies.

How Social Media Helps Financial Services

Social media marketing for financial services is the solution that brands need to build brand awareness, cultivate trust, and generate leads. In particular, employee advocacy on social media can help financial services achieve these goals.

Employee advocacy is a marketing strategy where employees share brand messages and content with their professional networks on social media platforms (e.g., LinkedIn). Social posts from employees are viewed as more authentic and trustworthy, which in turn, builds brand awareness and trust.

One of our favorite brands with an employee advocacy program is MasterCard. Mastercard is an excellent example of a financial services brand harnessing the power of employee advocacy. The company uses employee advocacy to create stronger engagement with its customers and prospects.

Through MasterCard’s Employee Ambassador Program, it incentivizes its employees to share brand news across personal social networking accounts. Simply, type #mastercardambassador on X, and you’ll see partners and employees contributing to the hashtag.

How To Increase Employee Advocacy

To maximize your employee advocacy efforts on social media, you need to be strategic. Let’s take a look at a couple of ways that financial services brands can increase employee advocacy.

1. Tapping Into Influencer Marketing

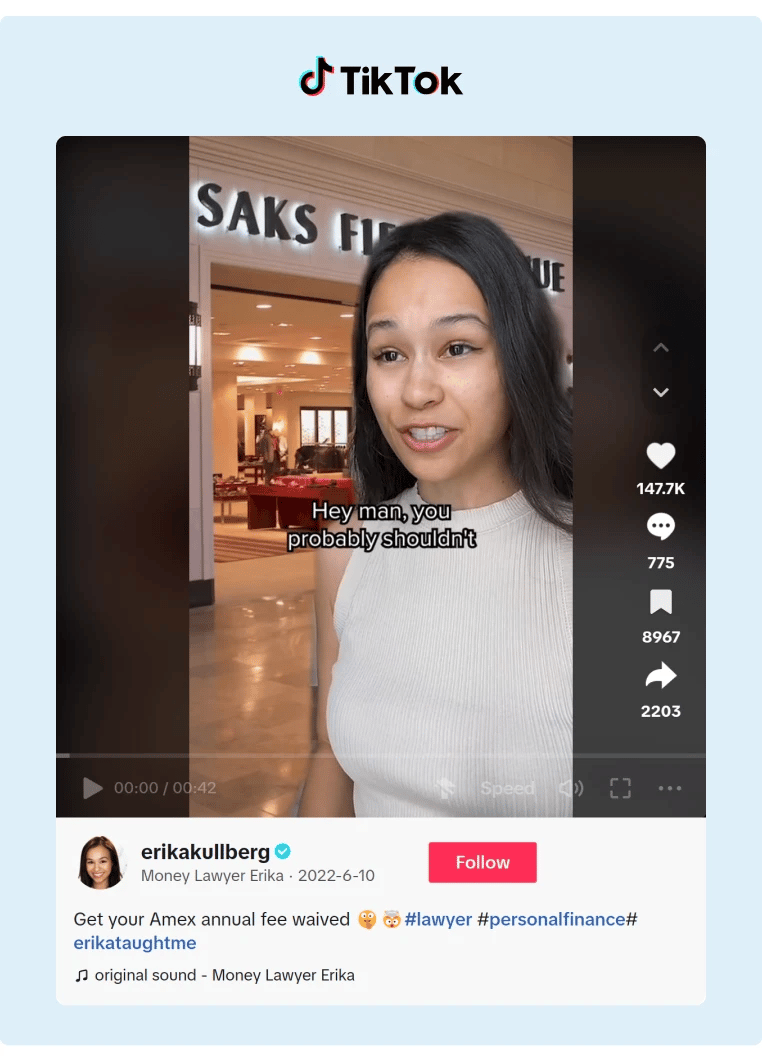

Collaborating with social media influencers is a solid way to increase your brand awareness. However, if you’re a financial services brand, you might be hesitant, and for good reason. Your brand reputation can easily be derailed by the actions of your collaborator.

Take the time to research potential social media influencers before partnering with one. Make sure they’re a good fit and make sense for your brand. When a strong financial brand and influencer match well, the results can give your employee advocacy a significant boost.

Source: Erika Kullberg

According to Troy Janisch, VP/Director of Social Intelligence at U.S. Bank, in a typical month U.S. Bank’s brand garners 15,000-20,000 social media mentions. But, when an influencer strikes a chord with a mention, that single reference can increase the breach by as much as 30,000 additional mentions. The boost continues to pay dividends for months as other followers share that post with their friends and followers.

So, it comes as no surprise that multiple financial companies like Chase, American Express, and Capital One are all expanding their advocacy expertise and have embraced the power of influencer marketing.

2. Utilizing Employee Advocacy Tools

Employee advocacy software and tools can help financial services brands streamline their advocacy efforts. For example, GaggleAMP is an easy-to-use employee advocacy platform with many benefits:

-

Increases Employee Engagement By Providing Specific, Personalized Instructions.

-

Provides Detailed Analytics and Proprietary Employee Advocacy Benchmarking Data.

-

Offers a Robust AI Tool to Make Content Creation Easier.

Utilizing employee advocacy tools will also tie into your content strategy for financial services, which brings us to…

Content Strategy for Financial Services

Financial services brands need a proven content strategy for their employee advocacy programs. Creating quality content is just part of the equation. An effective content strategy creates a process that ensures your financial services brand consistently publishes quality content geared towards company goals, and posts receive engagement from relevant employees.

Here are some steps to help you craft an effective content strategy:

-

Outline Company Goals. In this case, the primary goal is to build trust. Other goals may include generating more traffic, likes, and shares to increase brand awareness.

-

Select Social Platforms. Determine which platforms your employees and prospects are most active on. For financial services, LinkedIn will definitely be a top platform.

-

Create Engaging Social Content. Focus on content that is personable and relevant to your target audience. For example, if it’s tax season, creating and sharing a brief video on tax preparation tips is both relevant and can be engaging.

-

Offer Employee Advocacy Platform Training. Ensure that your employees know how to use the employee advocacy platform you’ve selected, and that they feel comfortable using it.

In addition to these steps, due to the financial nature of these brands, some legal aspects need to be incorporated into the content strategy, as well.

Regulatory bodies like the Financial Industry Regulatory Authority (FINRA), Federal Trade Commission (FTC), and the US Securities and Exchange Commission (SEC) are responsible for enforcing supervision and fair communication methods to ensure market integrity.

Financial services brands need to be aware of these brands and their various rules that need to be adhered to when it comes to public communication. For example, FINRA’s Rule 2210 has guidelines on content standards. Meanwhile the FTC, on its part, has put out a comprehensive guide that emphasizes transparency by employees and the responsibility of companies to formalize employee advocacy for more effective compliance when it comes to endorsing financial products and services.

Social media content curation must also be guided by:

- Proper record and bookkeeping practices.

- Supervision for both static and interactive content.

- Third-party content supervision as per FINRA and Federal Securities law.

- Suitability rules pertaining to electronic communications, especially around the recommendation of specific products.

- Fair and balanced communications for transparency around risks and to avoid misleading, exaggerated, and unwarranted statements.

Now let’s take a look at how to craft an employee advocacy strategy, which delves deeper into the nuances of compliance for financial services brands.

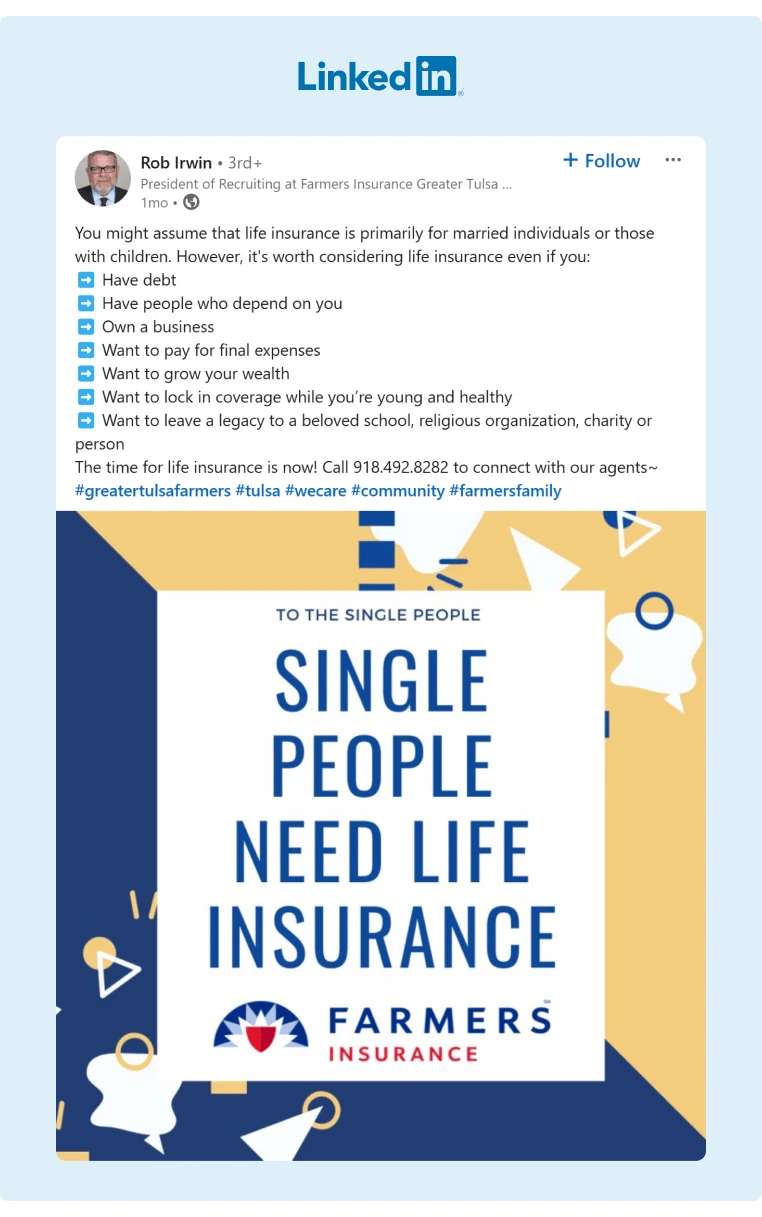

Employee Advocacy Strategy for Financial Services

An employee advocacy strategy is a content promotion technique where employees engage with and share branded messages with their professional social networks to increase organic impressions and reach more potential clients.

Source: Rob Irwin

Due to sensitive information, an employee advocacy strategy for financial services will heavily focus on compliance and regulatory aspects.

Compliance is a vital feature of managing your social media amplification policy. In a highly regulated sector like finance, the potential legal and financial implications of non-compliance can be devastating.

For financial institutions, this translates to managing reputational risks from content dissemination, navigating legal frameworks, and handling third-party interactions. Last year, the SEC charged New York-based FinTech investment adviser Titan Global Capital Management USA LLC for misleading use of hypothetical performance metrics in one of its advertisements.

Most commonly, regulatory lapses in finance occur in relation to laws such as:

- The Truth in Lending Act (TILA).

- Federal Trade Commission Act.

- Financial Industry Regulatory Authority (FINRA) Rules.

- Truth in Savings Act (TISA).

- Securities Act of 1933.

- Securities Exchange Act of 1934.

- Investment Advisers Act of 1940.

Financial institutions like public and private banks, credit unions, and insurance companies are all subject to regulatory mechanisms in the promotion of their services. This is done to protect investors and other consumers from the power imbalance, making information supply transparent and fair.

Compliance demands signaling from the top order; it is management that must set uniform expectations and educate employees to balance brand alignment with individuality. It is critically important, therefore, that financial service providers pay due attention to it.

With this in mind, you can help thwart potential problematic social media posts shared by employees with a great employee advocacy platform. An employee advocacy platform allows for a small number of people to curate the content to share on behalf of the rest of the company. Then, when the activity is given to a team member, it can be locked from editing to ensure that compliance remains intact.

Why Financial Services Employees Need To Be Active on Social Media

Employees can create a bridge between companies and consumers by breaking down complex financial information and sharing insightful content such as market analyses.

Engaged Workforce and Improved Trustworthiness in the Market

As a comprehensive report by Edelman finds, clients are far more prone to trust employees rather than CEOs. It corroborates the fact that brand trust is closely linked to employee voices, as people are more likely to trust someone they can relate to over executives. It is in this context that employee advocacy programs come across as a fantastic way to meet people’s expectations and benefit from increased ROI. It humanizes the brand and gives a more authentic feel to corporate information and branding.

According to the Hinge Research Institute, professional engagement on social media has upsides for employees as well. Approximately 68% of the employees surveyed by the Institute said that it had helped their careers in several ways. That included:

- Attracting new business opportunities.

- Allowing them to develop high-demand skills.

- Helping keep up with industry trends.

- Differentiating themselves from their peers.

Internally, you should allow for friendly competition and gamification to aid excellent standards in your advocacy efforts through employee-driven social-media outreach.

Employee engagement has multiple and far-reaching benefits, such as strengthening company culture and improving brand sentiments.

Financial Services Employee Advocacy Examples

Now that we’ve reviewed the importance of strong employee advocacy for financial services brands and how social media is beneficial, let’s take a look at some examples.

Here are a few of our favorite financial services brands using employee advocacy on social platforms to grow brand awareness, boost engagement, and build trust.

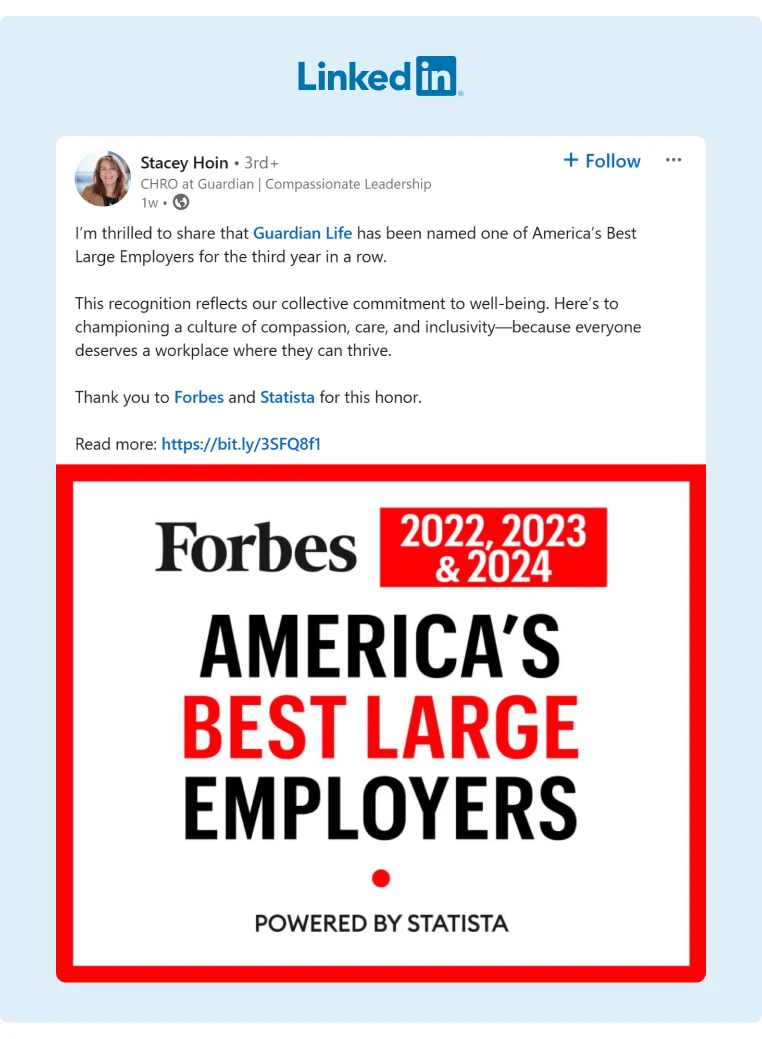

1. Guardian Life of America

Sometimes posting accomplishments can come off as “braggy,” but not so much when it’s your employees sharing the good news thanks to employee advocacy.

In this example, CHRO Stacey Hoin shares that Guardian has been named one of America’s Best Large Employers for the third year in a row. Not only is that a great achievement, but when a company is recognized as a great place to work, it attracts the attention of potential employees as well as clients.

Source: Stacey Hoin

2. London Stock Exchange Group

When it comes to showcasing progressive workplace policies, LSEG stands out through its employee-driven communications. Senior Manager Rob Coble shared an update about LSEG's industry-leading parental leave policy, which offers company-wide 26 weeks at full pay.

This highlights LSEG's commitment to supporting its employees' family life and positions the company as a forward-thinking and caring employer. Employee advocacy on social platforms like LinkedIn boosts LSEG's reputation as a great place to work and makes it an attractive opportunity to potential employees and clients.

Sourced: Rob Coble

3. Shore Capital Partners

At Shore Capital Partners, the celebration of new partnerships and acquisitions is amplified through the voices of their leadership team on social media. Jeffrey Williams, the COO of Shore Capital Partners, shared news of the firm's latest healthcare partnership with Cook Medical, a medical device company known for its investment in niche products.

The announcement highlighted the strategic acquisition of the Otolaryngology/Head and Neck Surgery (OHNS) family of products from Cook Medical and welcomed Kevin McLeod and his team to the Shore family. Such posts by company executives cultivate a sense of pride and community among employees and stakeholders.

Source: Jeffrey Williams

GaggleAMP: Your One-Stop Service for Employee Advocacy

Employees are the most important asset that a company has, and being able to capitalize upon this resource while also improving engagement is an excellent way forward for your growth.

Utilizing an employee advocacy platform like GaggleAMP will not only streamline but also maximize your employee advocacy efforts.

Our cost-effective employee advocacy program has glowing reviews. Rachel Foster, Digital Marketing Manager at Quantum, states: "I love how easy this product is to use and how much marketing budget we've been able to save through social amplification and employee advocacy."

You can take a look at our various successful case studies, pick a suitable plan based on our affordable pricing strategy, and get started with employee advocacy right away!

Schedule a demo with us today for more information.