Social Media Marketing for Financial Services Tips

For the financial services industry, the heyday of using expensive print ads and even more expensive 10-second TV spots to reach its audience is clearly over. With Millennials and Gen Z using social platforms like Instagram and YouTube to access services, make purchase decisions, and even handle their finances, it’s time for a change. That change is spurring the use of social media marketing for financial services.

Savvy financial services firms are leveraging social media platforms to reach consumers. However, without a social media marketing strategy for financial services in place, they risk throwing money again down the drain.

In this article, we’ll explore marketing strategies for financial services to amplify their social media presence and reach the right audiences. We’ll also help you craft a social social media financial services strategy plus share the best social media platforms for financial services.

So, grab a latté, and get ready to level up your social media game!

Why Financial Brands Can't Afford To Ignore Social Media

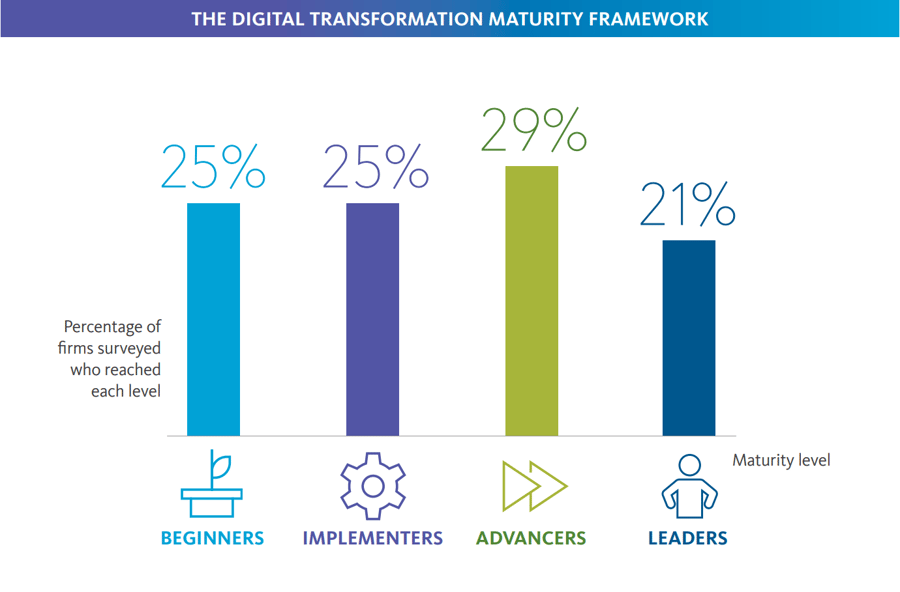

In 2022, half of the financial services C-suite executives who were surveyed considered themselves ‘beginners’ or just ‘implementers’ when it came to digital transformation, while only 21% felt they were ‘leaders.’

Source: Broadridge

Their hesitation to embrace social media isn’t unusual; financial services firms have always been wary of violating regulations and incurring reputational risks, and social media heightens those risks.

But, there’s increasing evidence that the tides are turning. According to Putnam’s 2023 Social Advisory Survey, 94% of financial advisors are using social media for business.

So, what’s driving the change? The benefit of a smart social media strategy is that risks can now be mitigated. In particular, compliance is driving the use of social platforms like LinkedIn, making it a major reason that LinkedIn is the primary network for financial services firms. In fact, 46% of advisors say LinkedIn is the only network allowed by their firm.

Financial services who are leaning into social media marketing are reaping the rewards. Companies with an optimized social media presence are increasing positive sentiment, reducing service response times, amplifying content reach, and generating high-quality inbound leads.

But beyond just direct customer metrics, social platforms provide critical mechanisms for crisis communications, reputation management, employer branding, and more. In other words, they deeply impact nearly every facet of a modern financial brand.

Ignoring social media means overlooking the main digital spaces where your brand reputation is being shaped. It’s time to move beyond legacy thinking and get proactive about optimizing your organization's social ROI.

The first step: develop a financial services social media strategy.

Financial Services Social Media Strategy

To stand out from the competition, strengthen your brand reputation, and generate quality leads, it’s essential to have a solid social media marketing plan in place. So, we’ve compiled our go-to social media marketing tips and content ideas for financial services to help you get started.

Here are our top nine social media marketing tips for financial services:

1. Create Content That Your Audience Wants To Engage With

The first step in any effective social strategy is understanding the type of content your target market finds truly captivating.

For example, 34% of customers revealed they don’t like it when brands are too focused on self-promotion.

So, skip the blatant self-promotion, and instead, identify the major pain points and key topics that your prospective clients care most about. You can do this through customer interviews, industry research, and social listening. Then, craft creative, thumb-stopping visual content directly targeted to those interests.

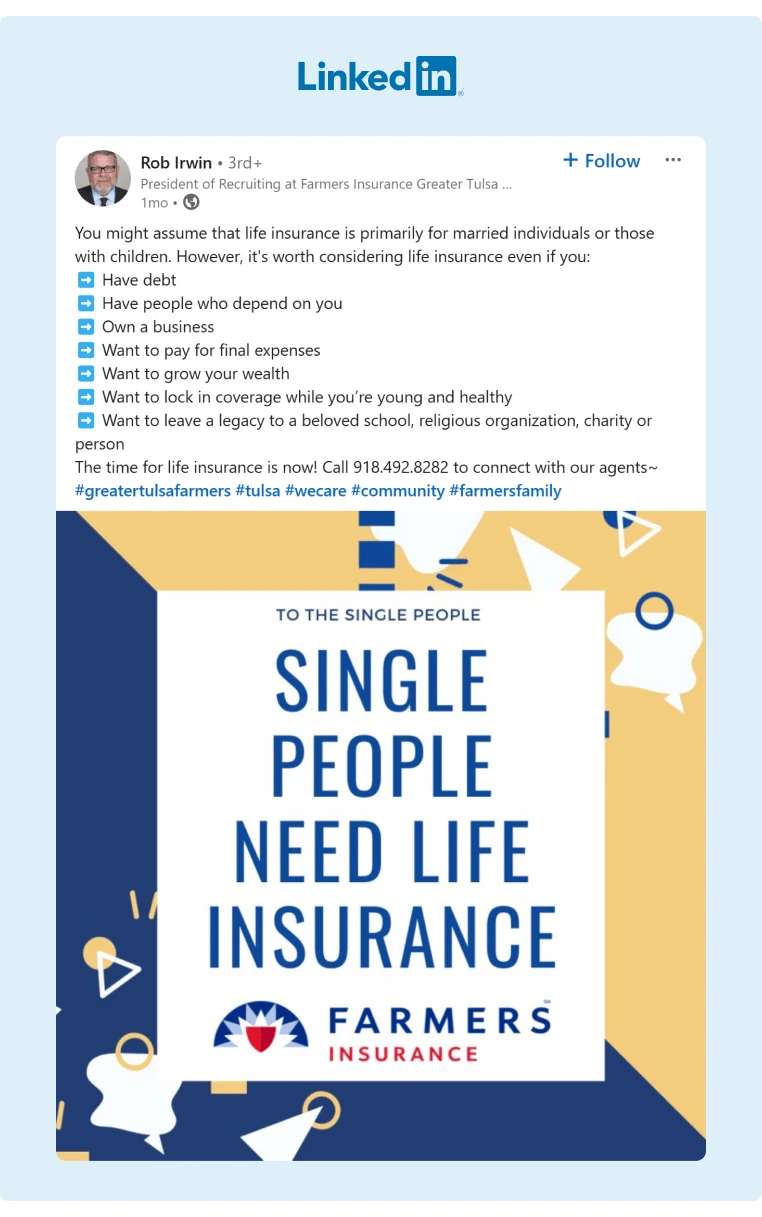

Source: Rob Irwin

For an industry that is more professional than laid-back, it might feel out of your comfort zone at first. But, if you can make your content engaging, while still being professional, you’ll win your customers’ attention and loyalty.

Content ideas can revolve around:

- Giving financial advice for Millennials buying their first home.

- Sharing budgeting tips for small business owners.

- Posting relatable (but appropriate) money-themed memes that get people laughing.

Always prioritize being helpful and relevant over promotional. Ultimately, the brands people follow and remember are the ones that enhance their lives.

2. Become an Authority Through Optimized Video Content

While image posts are easily digestible, video allows you to pack substantially more information and personality into a single piece of content. A majority of marketers report that video is the most valuable content type for achieving social media marketing goals.

Platforms like YouTube are incredibly useful. Viewers on the platform are 2x more likely to buy something they saw on YouTube and 4x more likely to use YouTube over other platforms to find information about a brand or service.

Now imagine using your financial service firm’s YouTube channel to answer common client questions in snappy two or three-minute tutorial videos. Let’s take it a step further, you offer your audience a breakdown of complex wealth management or retirement planning topics through animated explainer videos and motion graphics that simplify concepts.

Source: Debt Free Millennials

You can even repurpose or share your most compelling videos across other social sites, experimenting with new Gen Z-friendly sites like TikTok to extend your reach and SEO value. Best practices include optimizing titles, descriptions, and hashtags.

Making your expertise accessible through bite-sized video content establishes trust and positions you as the go-to authority.

3. Build a Community Around Financial Education

Although increasing sales is always a priority, aim to use social media for the larger goal of fostering an engaged community. Financial education is a great topic to center your communities on. For example, you can create Facebook or LinkedIn Groups where members can discuss money matters, support each other, and gain education from your team. You can also think of organizing ‘Ask Me Anything’ Zoom sessions with your expert advisors that you later use snippets of in YouTube videos and clips.

You can also identify avid finance hobbyists and influencers and invite them to co-create content like webinars. These brand advocates become powerful influencers on your behalf while also benefiting from leadership opportunities.

Remember, don't just talk at your audience but facilitate peer connection and collaboration. Social media then becomes an interactive extension of your service beyond just broadcasting promotions.

4. Mobilize Your Team as Brand Advocates

Your employees are your best asset for amplifying social media reach and supercharging your external marketing. After all, people inherently trust personnel affiliated with a brand more than the brand itself. Trust is a key benefit of employee advocacy for financial services. Messages shared by employees went 561% further than the same messages shared on the brand’s channel.

Implement an employee advocacy program that makes it effortless for teams to share approved company content on their personal social channels. A solid employee advocacy platform will enable you to provide specific, personalized instructions to employees, provide detailed analytics and benchmarking data, offer AI-powered tools to simplify and enhance content creation, as well as create a culture of sharing and engagement.

You can even incentivize participation with gamification, such as monthly rewards for the top employee contributors to increase adoption. Just ensure your strategy empowers staff while still respecting personal boundaries around privacy, job roles, and how their platforms are utilized.

5. Partner With Relevant Influencers in Mutually Beneficial Ways

While employees are your most authentic brand advocates, macro-influencers can also propel your social media exposure. But, that’s only if the collaboration is strategic and well-aligned!

Identify relevant influencers or thought leaders whose personal brand authentically aligns with your product/service and values. For example, you might partner with a finance TikToker for a co-branded video series if your target audience matches their followers. Sponsoring an entrepreneurship podcast where you host your advisors as guests could be another idea.

Source: Financial Freedom with Tori Dunlap | The Man Enough Podcast

The key is to focus partnership terms around measurable outcomes beyond just paying for one-off posts. You can think of offering pro-bono consulting in exchange for your influencer partners arranging an ‘Ask The Expert’ chat with their audience. True partnership means crafting mutually beneficial terms resulting in an authentic, higher-impact promotion.

6. Define Your Brand Voice and Messaging

Having a well-defined brand voice is essential for building brand recognition and trust. What is the core identity and personality that you want to consistently communicate? Is your brand persona educational and conversational, or perhaps more authoritative and reassuring?

Visual identity also matters: brand kits with proper logo formatting, color palettes, font libraries, etc. allow everyone on your team to stay on-brand.

Ensure your social media guidelines encompass best practices for everything from grammar and tone to approved hashtag lists and visual aspect ratios. The more you centralize and document these standards, the more seamless your brand messaging becomes across teams and platforms. These considerations are important because social consistency equals brand trust.

7. Use Analytics To Optimize Your Strategy

The beauty of digital marketing is having robust analytics to measure social media performance and refine your strategies over time. But, you only optimize a strategy after you try it.

While social listening, A/B testing, and consistent reporting should always guide incremental improvements, be willing to experiment creatively as well.

Pushing your team to brainstorm bold creative ideas and then measure their impact prevents strategies from stagnating. Trailblazing innovative social solutions often produces the most differentiated, talk-worthy results.

Just make sure to balance new ideation with clear KPIs and analytics reviews. Creativity powers your biggest wins, but data refines their efficiency.

8. Craft an Inclusive and Diverse Brand

Having an inclusive and diverse brand is a value many brands strive to achieve. Optimize your website for disabilities, impairments, and learning differences, with solutions like image captions, text enlargement options, and readable color contrasts.

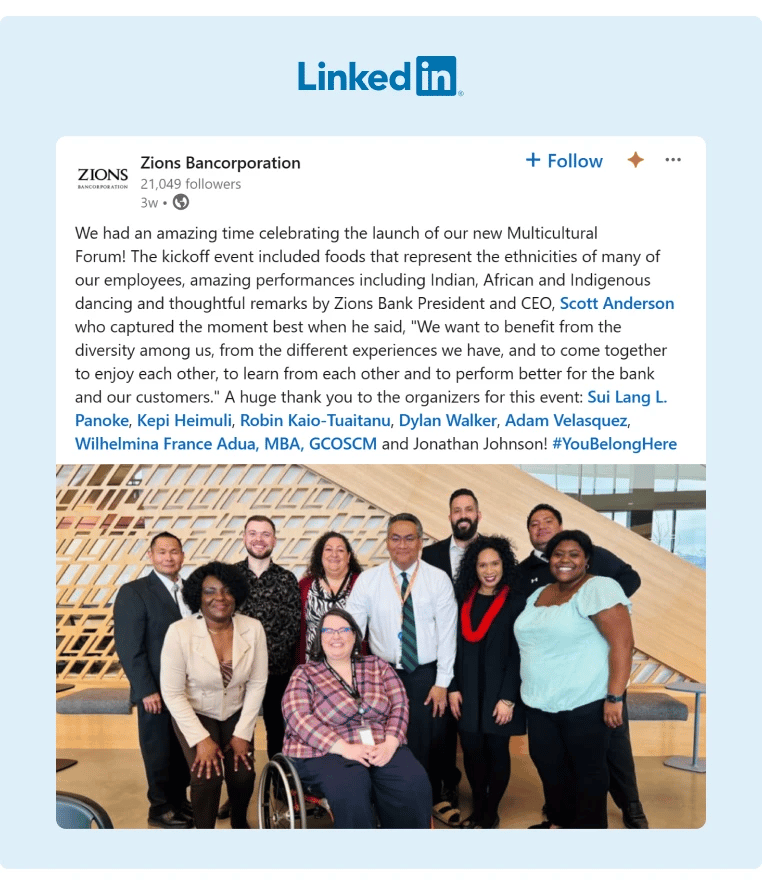

Source: Zions Bancorporation

Make your brand imagery and campaigns reflective of the diversity found in your client communities. Amplify and co-create content with influencers from underrepresented categories in your industry and promote smaller entrepreneurship initiatives.

Accessibility and inclusion build brand trust, and trust makes clients far more likely to engage, share feedback, and become loyal advocates.

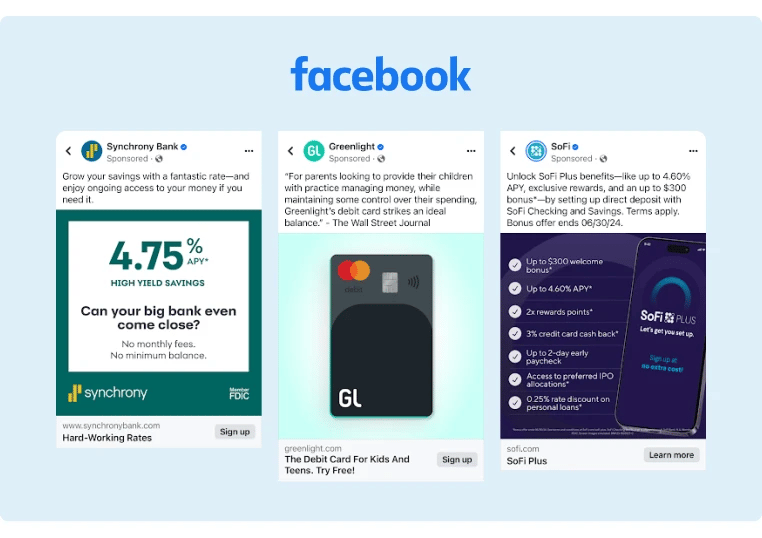

9. Leverage Data Integrations for Personalized Targeting

Social media ad platforms offer powerful options for reaching specific target audiences. But, too often, financial marketers only scratch the surface of these segmentation capabilities.

Enrich your native social targeting with integrations to your first-party customer and transactional data. You can hone hyper-targeted parameters around account types, product ownership, investment patterns, credit attributes, and more.

The options are virtually limitless, ranging from suppressing recent mortgage customers from home equity ads and focusing private banking communications only toward qualifying high-net-worth individuals to dynamically adjusting creative messaging depending on consumer spending habits.

An investment in real-time data integration allows you to surgically deploy social ad spend for maximum efficiency and relevance. Using closed-loop attribution models will help calculate the extent of the role played by each channel, campaign, and ad in converting customers. This allows for precise and continuous refinement of your campaigns.

Now that you have some of our best social media marketing for financial services strategies to help you get started, let’s take a look at some social media marketing examples and case studies.

Showcasing Success Examples

Here are three examples of financial services brands that are strategically using social media marketing to their advantage.

1. Fidelity Investments

Fidelity Investments’ Work & Wallet is a monthly newsletter where finance meets career advice. In its February newsletter, they discussed what to do with old 401(k)s, outdated career advice, and how Denise Chisholm, Director of Quantitative Market Strategy at Fidelity, inspires her colleagues and teaches her daughters about investing.

Clients of Fidelity Investments, or anyone who wants investment advice, can simply click on the LinkedIn post and subscribe. This tactic is a great way to share knowledge and generate new Fidelity customers.

Source: Fidelity Investments

2. Progressive Insurance

Progressive Insurance has mastered the art of engaging with customers on social media through its character-driven campaigns, notably featuring "Flo," their brand ambassador. By creating a series of humorous and relatable posts, videos, and interactive content, Progressive has humanized its brand making insurance topics more accessible and engaging.

Their strategy includes leveraging platforms like X and Facebook for customer service, offering quick responses and solutions. This also enhances their reputation for customer care and has led to increased brand loyalty and customer engagement.

Source: Progressive

3. QuickBooks

QuickBooks uses social media to provide valuable content to its audience, focusing on small business owners and freelancers. Through platforms like Instagram and LinkedIn, QuickBooks shares tips, tutorials, and user stories that resonate with their target demographic. They use visually appealing infographics and short videos to break down complex accounting tasks into understandable and actionable advice.

This strategy positions them as an authority in the financial software space and builds a community of engaged and loyal users who see QuickBooks as an indispensable resource for their business operations.

Source: Intuit QuickBooks

GaggleAMP: A Focused Approach Towards Financial Services

An employee advocacy platform like GaggleAMP is ideal for financial services companies concerned with compliance and safety. With GaggleAMP, you have the ability for all posts to be curated by a member of the team before an employee shares it with their network.

Here’s what makes GaggleAMP unique:

-

Increases Employee Engagement by Providing Specific, Personalized Instructions.

-

Provides Detailed Analytics and Proprietary Employee Benchmarking Data.

-

Offers a Robust AI Tool To Make Content Creation Easier.

By using GaggleAMP for their employee advocacy and social media marketing needs, financial services firms can rest assured that their content is compliant and can be optimized if needed.

Looking Ahead: The Future of Social Media Marketing in Financial Services

Mastering social media is essential for financial services firms that want to build communities, establish brand authority and trust, and attract consumers. Without it, you stand at a significant disadvantage.

While helpful, you don’t need a social media marketing degree to build and execute a successful social media marketing plan. Educating yourself on relevant social media industry trends and using social media marketing tools like an employee advocacy platform will help you. Get started on the right foot by implementing an employee advocacy platform with GaggleAMP.

Request a free demo today to see how your financial services firm’s social media marketing can reach new heights!